Kickstarting Savings with a Savings Challenge

It is a brand new year and with it comes the opportunity to do better than the prior-year in all aspects. One of those major aspects is money - chelete, finances, income, savings, investments. The good thing is that for the most part, there is always a community around finances ready to help you on your journey to becoming more financially savvy. Here is what you can do to kickstart or boost your savings.

A downloadable excel document with all 4 savings challenges outlined below can be found here.

Savings - the act of putting money away in a safe place to use it in the future.

Every individual should endeavor to have some form of savings and an understanding of a budget - the exact amounts of monthly financial expenses & deductions, so that you can clearly deduce income and expenses, as well as funds remaining or not at the end of the month. You can attempt to organise your finances using the 50/20/30 rule - 50% should go towards fixed expenses - necessities, 20% towards savings and investments and 30% should be reserved for any additional costs that vary such as petrol, groceries, entertainment, eating out, etc - lifestyle choices.

Why start saving:

It gets you in the habit of putting money aside and not spending your entire monthly salary.

It allows you to plan your funds for future endeavors - setting goals for your money. The goals should be SMART - Specific, Measurable, Achievable, Relevant, Time-bound.

Opens up possibilities and thinking from a perspective of excess and opportunities. - how can I afford it as opposed to it is too expensive.

Enables funds to be available for emergencies - build an emergency fund covering 3 - 6 months of your living expenses, or the reverse, 3 - 6 months of your current income. If you can save 6 - 12 months as emergency funds, the better.

Instills discipline with your funds, strengthening your focus and consistency towards preserving money.

There are various savings challenges available that can help you build your savings. What is important is finding the appropriate savings plan that you can be consistent with for the entire year.

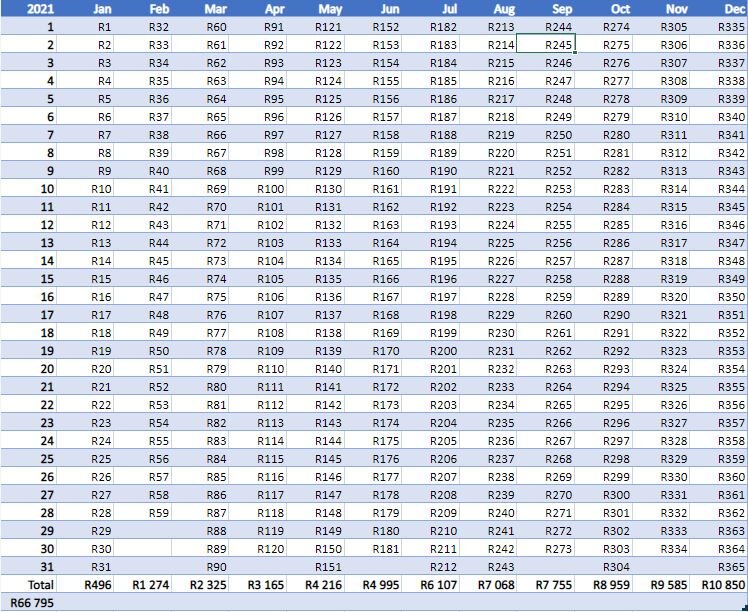

One Rand Challenge = R66 795

10C Challenge = R6 679

A great starting point for first-time savers. Save daily in increments of R1 until the last day of the year, day 365 where you save R365 for the day.

1 January is day 1 - save R1.

10 January is day 10 - save R10.

1 February is day 32 - save R32.

31 December is day 365 (366 in a leap year) - save R365.

There are variations of this challenge including:

Saving 10c a day, R5 a day, or R10 a day.

Saving R5 or R10 a week instead of a day.

Saving the monthly total instead of the daily amounts.

Savings plans are adjustable, you can make them flexible to what suits you, as long as you are saving!

The Ladder Challenge = R 7 800

The Ladder Challenge is a monthly savings plan in R100 increments. The following year, the starting point will be double the amount of the previous January’s contribution, then R100 increments thereafter, growing your savings total of the year by at least 10% from the previous year.

52 Week Savings Challenge = R13 780

This commonly known savings plan has weekly targets, with increments of R10 from the previous week. The 52 Week Savings Challenge can be reversed to start with the highest amounts in January and end with the lowest in December

i.e Week 1 save R520, Week 2 save R510…Week 52 save R10.

There are various 52 Weeks Money Saving Apps on Google Play and Apple App Store, please read through reviews and understand where the funds are placed if you intend on using these apps.

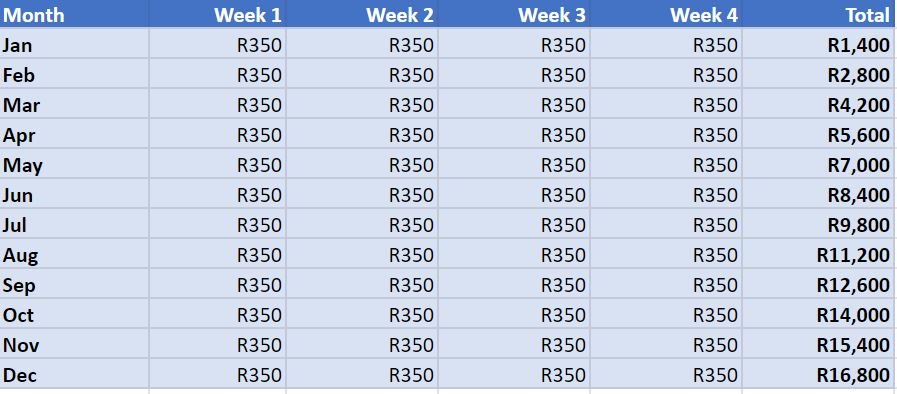

R350 Savings Challenge = R16 800

A weekly challenge where you save a fixed R350 every week of the month. Assuming 4 weeks in a month, you are saving R1400 every month. You can also do a once off r1400 per month, but the weekly version can help you keep accountability on a weekly basis.

Join the Twitter community with @emukumbo as they take on this savings challenge.

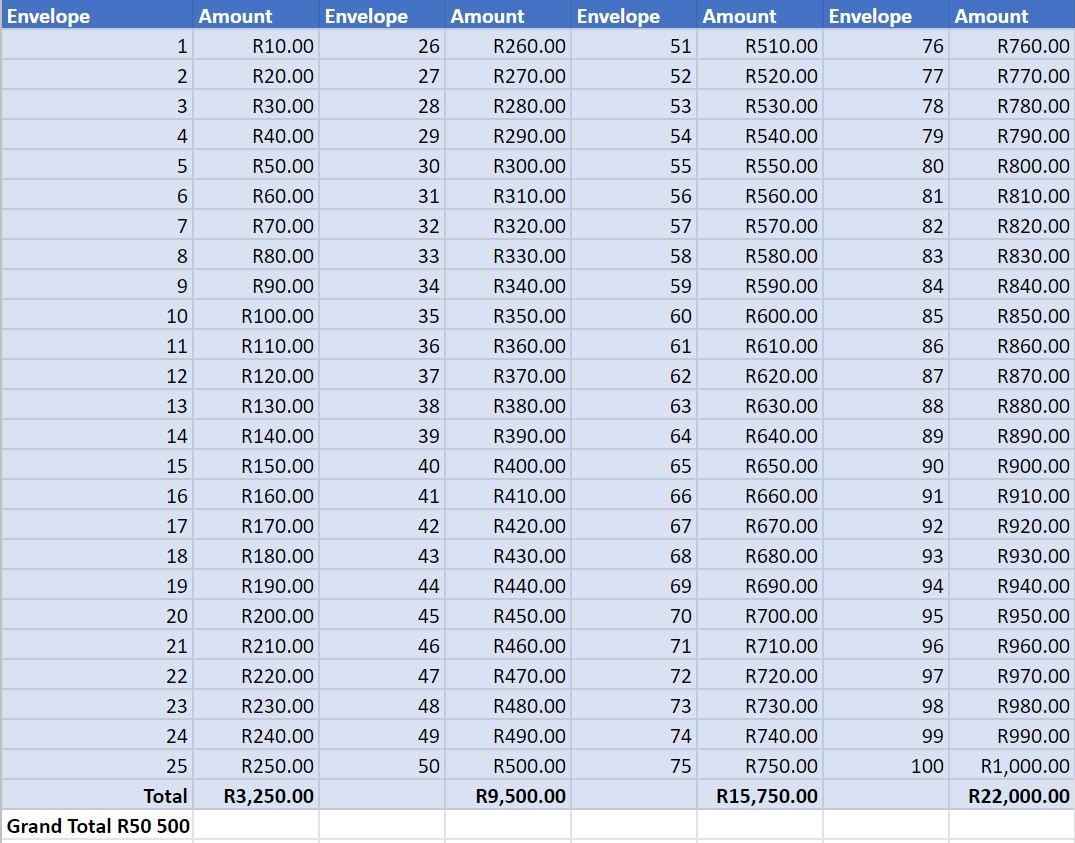

100 Envelope Challenge = R50 500

Using envelopes, you can put in amounts from R10 to R1000 (or whatever denominations you choose). Assuming you are starting with the R10 and each envelope increases with an amount of R10, by the end of the 100 envelopes you should have saved R50 500!

You can save at whatever point you want, as long as you get to 100 envelopes by the end of the year whilst keeping track of when you add amounts to an envelope. Watch this NomazDiary TikTok on how she does it

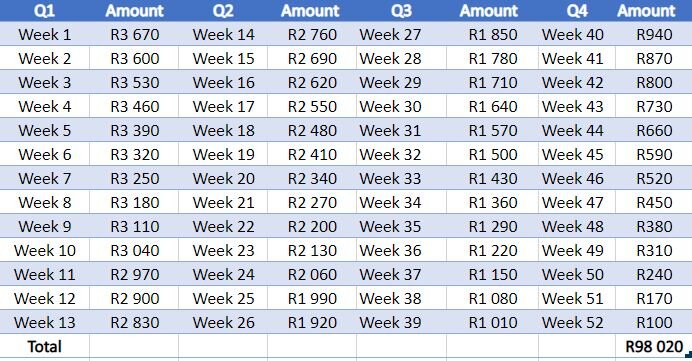

The Dividend Papi 52 Week Savings Challenge = R98 020

If you want to challenge yourself even further, take part in this challenge started by Briteless. The premise is to start saving higher amounts which gradually decrease by R70 per week as the year progresses, making it easier to save by year-end and save nearly R100 000!

Join in the fun by following Bright Khumalo, aka Briteless on Twitter, notably known for the 10c and R1 challenges, and be motivated by the savings community he has established.

A downloadable excel document with all savings challenges can be found here.

Avenues for placing your savings

Ideally, the choice of where your savings are placed needs to consider the following:

A high interest yielding account, meeting or exceeding inflation forecast at 4% for 2021 by FocusEconomics Consensus Forecast panelists at the time of this post.

An account that allows you to continuously add or stop adding funds at any time.

As much as possible, limits accessibility to the funds, therefore consider accounts that have a longer notice period such as a 32-day notice account. This is highly dependent on the purpose of the savings, therefore have a goal linked to your savings.

No forms or fees app by Liberty, automatically save funds as little as R5 a day. Do your own research on the available portfolios for placing your funds, with the options of SA Top 40 Shares or into the Cash+ portfolio, or both.

This will be an investment avenue as opposed to savings, therefore you will need to do a risk assessment and personal research on the funds. You can earn 4 - 5 % on savings, and potentially earn over 10 % on investments. Franc invests money in either Cash Fund (Allan Gray Money Market) and/or Equity Fund (Satrix 40 ETF).

Goalsave is a free savings tool from Tymebank, with growing annual interest rates the longer you save with them, starting at 4% and up to 8% if your salary is paid into your TymeBank account. You can have up to 10 active GoalSaves with a total across the accounts not exceeding R100 000.

All banks (Standard Bank, Nedbank, FNB, Absa, Capitec Bank, African Bank, Discovery Bank, Investec) offer savings options, it is a matter of researching the kind of accounts and interest rates suitable to you. Do not be afraid to venture away from your day to day bank in search of better savings options elsewhere. Try to maximize on the free bank your change or similar offerings with your bank - where each transactional account card purchase value is rounded up to the nearest rand and the difference between your purchase amount and that amount is transferred into your Savings Account. You can choose the top-up amounts to be applied e.g. R2, R5, R10, R20, or R50. Each swipe adds that amount from your transactional account to the cents you have saved on your purchases, into your Savings Account.

Note - you can get up to 5000 Discovery Miles (R500) when you open a Discovery Bank Account using the referral code DDQ006.

A common and well-known form of saving, a stokvel is a savings pool where a group of individuals contributes an agreed-upon monthly amount. The group have full control of how they would like to use that money. Several banks offer stokvel accounts that can be managed as part of the stokvel group. What is essential in the success of the stokvel is:

Having a trustworthy group of individuals.

Clear goals and guiding principles.

Rules in the collection, storage, and dissemination of funds.

Although this is more of an investment option, it is an alternative to savings accounts as they offer higher interest rates with funds accessible within a few days however could be subject to monthly minimums of e.g. R500 per month. There is a broad range of money market funds available, do your research accordingly.

Tax-Free Savings Account (TFSA)

Returns are guaranteed and funds can be accessed at any time however annual savings are limited to R36 000 and a lifetime cap of R500 000. The benefits of a TFSA is interest income, capital gains, and dividends are tax-exempt, Any withdrawals from your TFSA reduce your lifetime cap i.e. if you contributed R33 000 in Year 1 and withdraw R20 000 in Year 2, your lifetime cap has now dropped to R467 000 (R500 000 - R33 000). Be sure not to treat your TFSA as a savings account for regular withdrawals but rather a long term savings account.

An access bond is a home loan type that allows borrowers who have paid extra money into their bond to withdraw these extra funds. Placing your savings in your access bond account enables you to save at the rate of interest of the loan without paying tax on the interest saved, which is almost guaranteed to be better than the interest earned elsewhere. Note, you can only withdraw the funds you have paid over and above the monthly instalment i.e. the excess.

Other risky avenues include investing in the stock market using EasyEquities or buying Cryptocurrency using Luno or Revix - Do note with these avenues, you need to do thorough research! As much as you can make a return on your investment, you could also lose a portion of your investment.

“The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.” T.T. Munger.

With all of this in mind, may you take the necessary actions in starting your year right, financially.